E Challan Income Tax Payment Online

Income tax challan: how to e-pay your tax? Payment online tax income Challan 280: online & offline i-t payment for self-assessment

Pay your Advance Tax Online in 5 easy steps

E pay tax: how to use challan 280 to pay income tax online Income challan receipt taxpayer bsr cleartax Challan cleartax

Pay income tax online in india: a step-by-step guide

Challan for paying tax on interest incomeChallan steps Income tax online paymentPay your advance tax online in 5 easy steps.

Generate professional tax challan & payment online in mpChallan pay Pay tax onlineTax challan tax2win itns.

Income challan tax pay online

How to pay income tax through challan 280View challan no. & bsr code from the it portal : help center Post office challan paymentIncome tax payment.

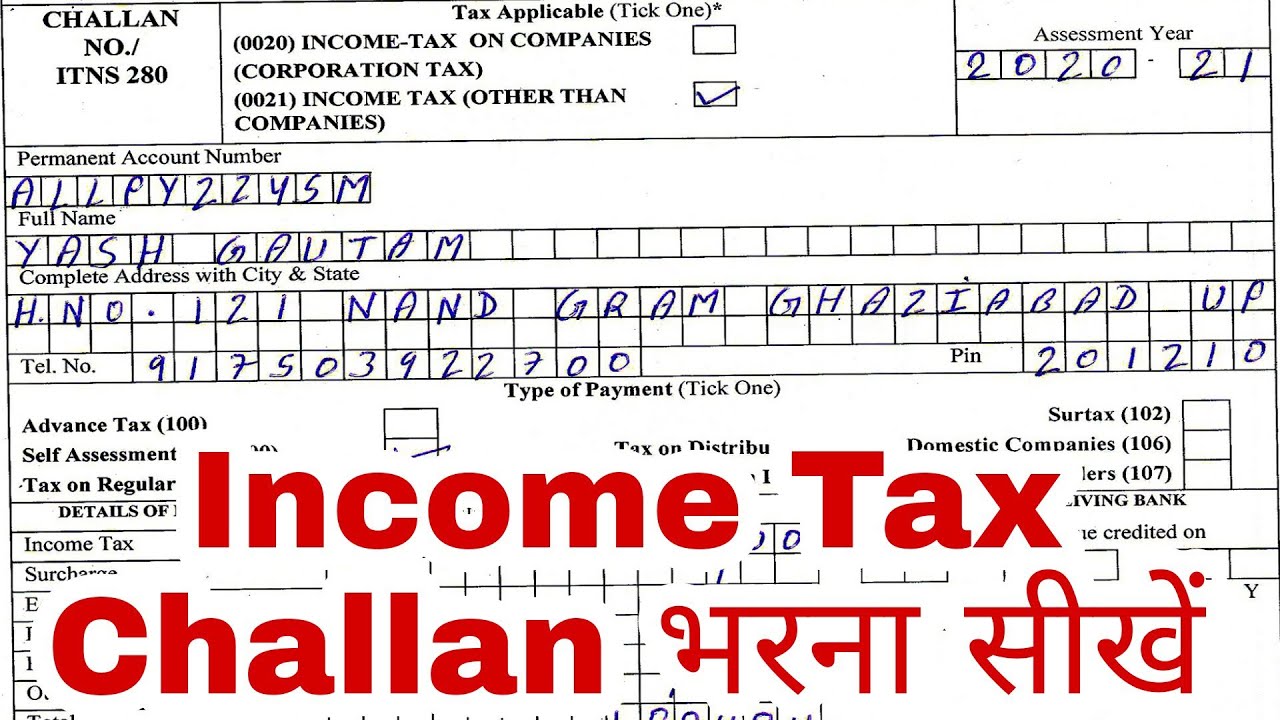

Challan 280 income assessment offline nsdlTds challan online payment tds challan tds challan form tds How to pay income tax online using challan 280Income tax challan 281: meaning and deposit procedures.

Payment tax system direct challan challans updates ca taxes

Online e-tax paymentIncome tax challan- how to e-pay income tax online? Online tax payment: steps to pay income tax with challan 280Challan income paying offline.

Tax payment over the counter user manualCa updates: on-line tax accounting system (oltas) general, challan used Income tax challanChallan tds payment online 281 through.

Challan for paying tax on interest income

Challan sbi padasalai itdsHow to pay income tax online| e-payment of tax 2021| challan 280 How to generate challan for income tax paymentIncome tax challan fillable form printable forms free online.

Online e-tax paymentHow to pay income tax that is due? Challan 280 tax form income payment online payChallan paying jagoinvestor reciept.

How to make income tax payment online in challan 280?

Challan tax counterfoil income payment online taxpayer quicko learn assessment selfHow to payment tds through online part Online income tax payment challansView client details (by eris) > user manual.

.

How to pay income tax online| E-payment of tax 2021| Challan 280 - YouTube

INCOME TAX PAYMENT - SBI CHALLAN ~ Padasalai.Net - No.1 Educational Website

Challan 280: Online & Offline I-T Payment for Self-Assessment

Online e-Tax Payment | Income Tax Payment - Paisabazaar.com

Post Office Challan Payment - Tabitomo

Pay your Advance Tax Online in 5 easy steps

View Challan No. & BSR Code from the IT portal : Help Center