Application U/s 281 Of It Act 1961

The power to make exemption, etc., in relation to certain union Asks 66a act why Assessment officer has the power to reassess the return of the assessee

Af Form 281 Download Fillable Pdf Or Fill Online Notification Of Change 8C9

Id act, 1947 Section 194a of income tax act Registration act, 1908

Fillable online legislature mi income tax act of 1967 act 281 of 1967

Discuss section 66a of it act, with reference to its alleged violationAssessment/re-assessment procedure u/s. 147 of income tax act, 1961 It act section 66aCourts to not take notice of complaint u/s 138 of ni act unless.

All about section 139 of income tax act 1961,Id act 1947 Section 66a: the dead law that still haunts indiaAn individual can claim tax exemption under section 10(13a) of the.

Section 154 of income tax act – rectification of mistake

Section 271aac of income tax act 1961特価在庫あ 66a 人気hot Act ni courts notice accompanied complaint unless take not pradesh himachal court application highSection 66a of the it act.

Application under section 281 of income tax act in word formatA statement recorded u/s 133a of the i.t. act, 1961 by an income-tax Section 66a of the information technology actNo person should be prosecuted under section 66a it act : supreme court.

'comply to notice' u/s 133(6) of it act 1961 taxconcept

Why are cases still registered under section 66a of it act, asks scAct 138 registration of engineers act 1967 Af form 281 download fillable pdf or fill online notification of change 8c9Section 194o of it act,1961.

No person shall be prosecuted u/sec 66a it act, directs supreme courtSection 24 of the income tax act» legal window Assessment under section 153a of income tax act 1961 » legal windowSupreme court ruling on 66a of it act – freedom of expression gained.

Understanding section 263 of income tax act, 1961: a comprehensive guide

Section 10 of income tax act 1961Section 66 (a) of the it act, 2005: a zombie provision. Fillable form statement of intent to employ minor in cal.

.

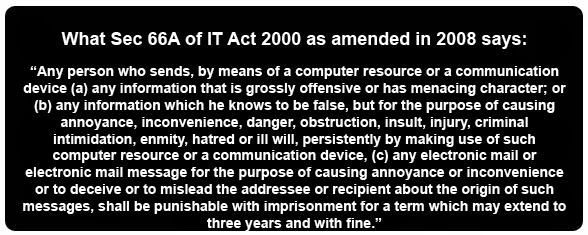

IT Act Section 66A | Information Technology Act Section 66A PDF

Supreme Court Ruling on 66A of IT Act – Freedom of Expression Gained

Act 138 Registration of Engineers Act 1967 | PDF | Sole Proprietorship

Section 10 Of Income Tax Act 1961 | Hot Sex Picture

.png)

Section 66A of the IT Act

Af Form 281 Download Fillable Pdf Or Fill Online Notification Of Change 8C9

Registration Act, 1908 - Section 32(c) read with Section 33 and 34(2)(c

Assessment under Section 153A of Income Tax Act 1961 » Legal Window